Frost & Sullivan reports that the number of oxygen patients is expected to double by 2005.

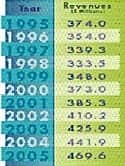

Such are the findings of the most recent market research survey by Frost & Sullivan, “US Oxygen Therapy Device Markets.” This study, which evaluates the state of the oxygen industry from 1995 to 2005, reports that not only is the patient base of those needing home oxygen increasing at a brisk pace, but more and more of those patients are likely to desire portability; however, those needs are at odds with the reimbursement squeeze.

Medicare oxygen reimbursement has, in fact, declined 30% in recent years, and is expected to sink even further if HCFA implements a national competitive bidding program. Since up to 40% of revenues for home oxygen services are derived from Medicare, the decrease in reimbursement is obviously one of the major challenges facing the industry at this time, though the impact is expected to decrease in 5 to 7 years.

Currently, the cuts are driving providers to renew efforts to extend the life cycle of products and curtail new purchasing as much as possible. Selling products in such an environment can be a major challenge for manufacturers in this field.

Still, though these reimbursement cuts have had a restraining impact on the oxygen market—the 1998 revenues represent an actual decline of 2% from the previous year—the Frost & Sullivan study determined that they may actually serve as a driving force for future growth. This is because cuts in reimbursement have resulted in fewer home visits, which has meant more—and more expensive—trips to the emergency department or to physician offices for care. Frost & Sullivan medical device analyst Laurence Ravat points out that “the savings obtained from treating patients in the home and other alternate care sites compared to hospitals is undisputed.

“The rise in inpatient expenditures will, in the long run, have the effect of easing cuts to the home care market, and provide the impetus for market growth,” she says.

Oxygen Therapy Devices Examined

The shift to patients needing mobility with their oxygen use has resulted in a need for more efficient oxygen delivery systems, ie, a shift from liquid to more portable services such as compressed gas cylinders. Oxygen conserving devices have been particularly well received by providers, as they extend the lifetime of individual compressed gas cylinders, thereby providing greater portability, reducing the frequency of visits to the patient’s home, and leading to cost savings.

Challenges to the Industry

One of the problems in the industry noted in the report is the high initial cost of switching to new products, which are often expensive because of the complex technology and intensive research and development required to establish them. As an example, there is currently a large and expensive service component to the home oxygen therapy system, which requires frequent visits to patients’ homes and lots of maintenance by providers. Innovations on the manufacturing front, such as the introduction of concentrators that can also fill cylinders in the home environment, have reduced the need for such frequent visits. However, providers used to the old system have been reluctant to make the switch to a new system, and have instead focused their energies on fighting Congress on the reimbursement issue.

Other industry problems include tough competition, in both the provider and the manufacturer side of the business. While the report notes that the demand for portable oxygen is high, the expense of liquid oxygen has prevented growth of unit shipments. According to the survey, experts say this niche will shrink even further in the future, with fewer firms competing in this market because of a combination of reimbursement cuts and decline in demand.

The study also notes that compressed gas, used as a backup for concentrators, is manufactured by only two US companies. Thus, this niche is extremely competitive, and new competitors are not likely to enter or succeed in the market unless it becomes better-priced.

An additional issue noted by the report is poor lobbying by home health organizations, which has set the industry back. Providers typically supply a wealth of services with the equipment, but their costs are consistently compared to those of the Department of Veterans Affairs, which provides very different services. The Frost & Sullivan report concludes that industry organizations have not been successful in educating Congress about this fact, and cites one cause as a lack of organization in the industry.

Strategies for the Future

The Frost & Sullivan report also includes a section on strategies for succeeding in the oxygen therapy device market. Many of the tips are geared toward strategies for marketing, research and development, and corporate decisions. The report’s advice may mean providers will be dealing with more “one-stop” manufacturers that offer a large product line. As it notes, “successful firms in the oxygen device market are also following the strategy of catering to different aspects of home health. By offering an extensive line of home health products, [such] firms have reduced contract negotiation costs for large home care providers and gained access to large contracts.”

Oxygen therapy manufacturing firms are in the process of improving product reliability and efficacy to help home care providers cut down on the number of visits to patient homes, thus reducing costs. The report mentions the introduction of the previously mentioned oxygen conserver, and comments on soon-to-be-introduced technology like patented, smaller-sized regulators that are expected to change the market share structure in the years ahead.

For more information on the report, call (650) 961-9000 or go to www.frost.com.

Liz Finch is associate editor of Dealer/Provider.